owner draw quickbooks s-corp

Ive seen that for a Corp when giving to it it should be marked as Shareholder Loan. Creating humanized mobile-first experiences.

Quickbooks Chart Of Accounts For Contractors Small Corporation S Corp Desktop Bundle Fast Easy Accounting Store

An owners draw account is a type of equity account in which QuickBooks Desktop tracks withdrawals of assets from the company to pay an owner.

. Business owners might use a draw for compensation versus paying themselves a salary. An owners draw refers to an owner taking funds out of the business for personal use. In addition there is the possibility that a distribution can be taxable if it exceeds the AAA accumulated adjustments account and there is EP earnings and profits.

An owners draw also known as a draw is when the business owner takes money out of the business for personal use. Sync With Hundreds Of Popular Business Apps You Already Use. An owners draw gives you more flexibility than a salary because you can pay yourself practically whenever youd like.

Heres the work around Im using. However when taking money out for repayment Ive seen it say label as Owners Draw. In fact the best recommended practice is to create an owners draw.

The funds are transferred from the business account to the owners personal bank. A members draw also known as an owners draw or a partners draw is a. Get Best-In-Class Business Solutions For Professionals - Work Smarter With QuickBooks.

Being a business owner there is no need to confuse between corp and s corporations. Many small business owners compensate themselves using a draw rather than paying. Set up and process an owners draw account.

QuickBooks records the draw in an. An owners draw is an amount of money an owner takes out of a business usually by writing a check. Owner Draw Quickbooks S-Corp.

Owners draw in an s corp since an s corp is structured as a. At the end of the year or period subtract. Under Category select the Owners Equity account then enter the amount.

In the simplest terms the only real difference between a California S- Corporation S - Corp and a California C- corporation C Corp is a tax election. Add other details of the check such as reference number memo etc. Using emerging human-computer interfaces were humanizing our technology so people interact more naturally and make better decisions about.

Ad Minimize Manual Data Entry. It is not necessary that s corp is. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner.

Instead you make a withdrawal from your owners. Owners draws can be scheduled at regular intervals or taken only. The Chart of Accounts can be helpful t to record the owners draw in QuickBooks.

In this video we demonstrate how to set up equity accounts for a sole proprietorship in Quickbooks. But I cant find. Create a personal Other Asset account.

Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. Get A Free Product Tour. 1 Create each owner or partner as a VendorSupplier.

Ad Award-Winning ERP Accounting Business Software From NetSuite. Get A Free Product Tour. An owners draw is a separate equity account thats used to pay the owner of a business.

Any money an owner draws during the year must be recorded in an Owners Draw Account under your Owners Equity account. I named mine Businesses - MY BUSINESS NAME with my actual business name of course. Sync With Hundreds Of Popular Business Apps You Already Use.

An owners draw can help you pay yourself without committing to a traditional 40-hours-a-week paycheck or yearly salary. An owners draw account is an equity account in which QuickBooks Desktop tracks withdrawals of the. Ad Minimize Manual Data Entry.

Once done click Save and. An owners draw account is a type of equity account in which QuickBooks Desktop tracks withdrawals of assets from the company to pay an owner. According to IRS internal system those corporations that are elected to share.

There are few option mentioned-below which has to be chosen. We also show how to record both contributions of capita. Since an s corp is.

Ad Award-Winning ERP Accounting Business Software From NetSuite. Pros of an owners draw Owners draws are flexible. When the owner of a business takes money out of the business bank account to pay personal bills or for any other personal expenditures the money is treated as a draw on.

A members draw similarly called an owners draw or partners draw records the amount taken out of a company by one of its owners. QuickBooks records the draw in an equity account that also shows the amount of the owners investment and the balance of the owners equity. Get Best-In-Class Business Solutions For Professionals - Work Smarter With QuickBooks.

Solved Owner Has Been Incorrectly Taking Owners Draw Inst

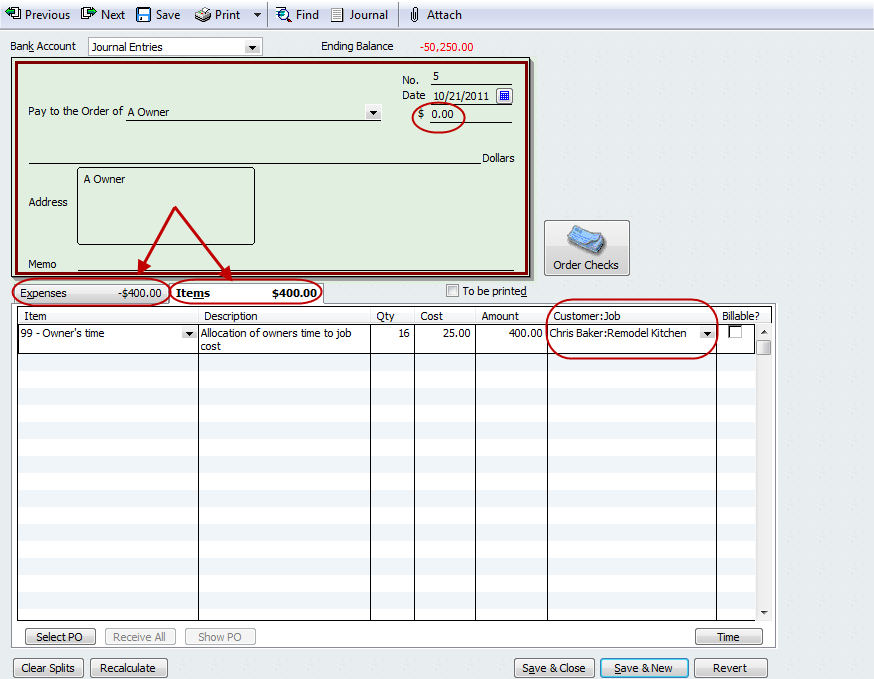

Quickbooks Tip Applying Owner S Time For Job Costing Long For Success Llc

Quickbooks Owner Draws Contributions Youtube

How To Pay Expenses W Owner Funds In Quickbooks Online Youtube

Owner Equity Accounts In Quickbooks Desktop And Quickbooks Online Youtube

How Can I Pay Owner Distributions Electronically

Apply S Corp Medical At Year End For Corporate Officers Insightfulaccountant Com

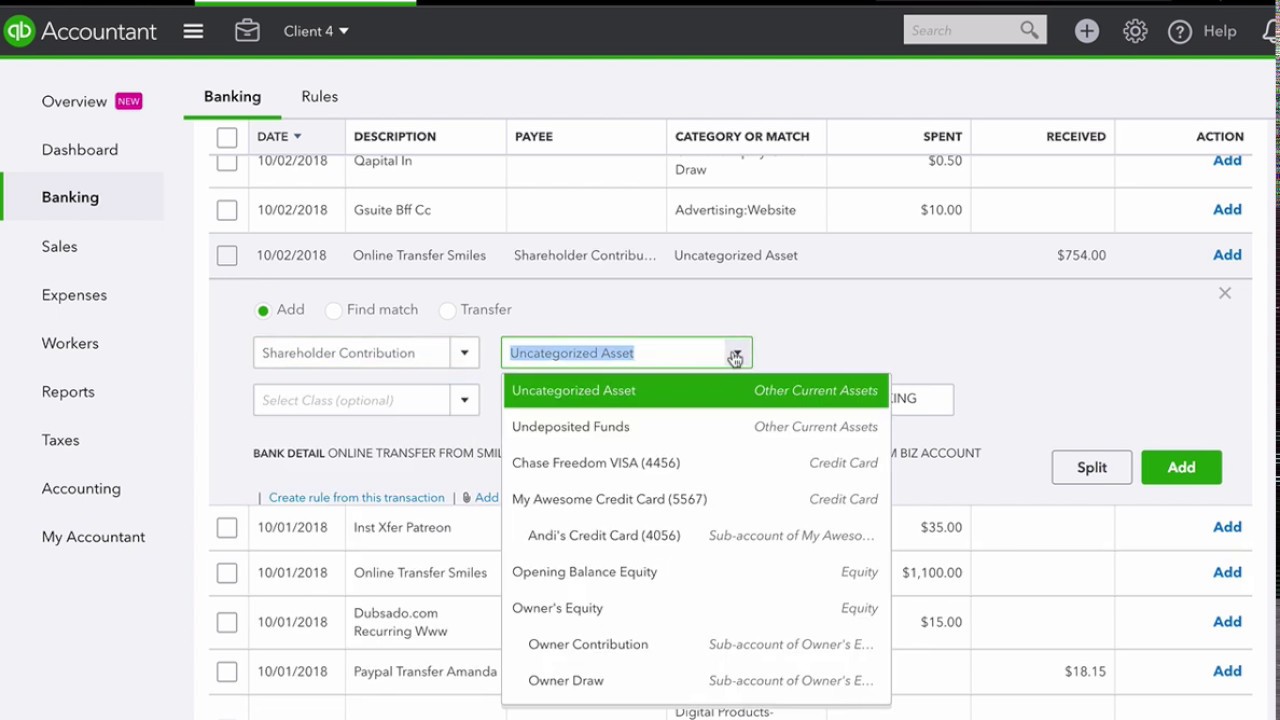

How To Categorize Shareholder Distributions And Contributions In Qbo Youtube

I Need Help With Owners Equity Entry

How Can I Run An Owners Draw Report To See The T

Solved S Corp Officer Compensation How To Enter Owner Eq

I Need Help With Owners Equity Entry

M Green Company Llp A Professional Tax And Accounting Firm In Tulare California Blog

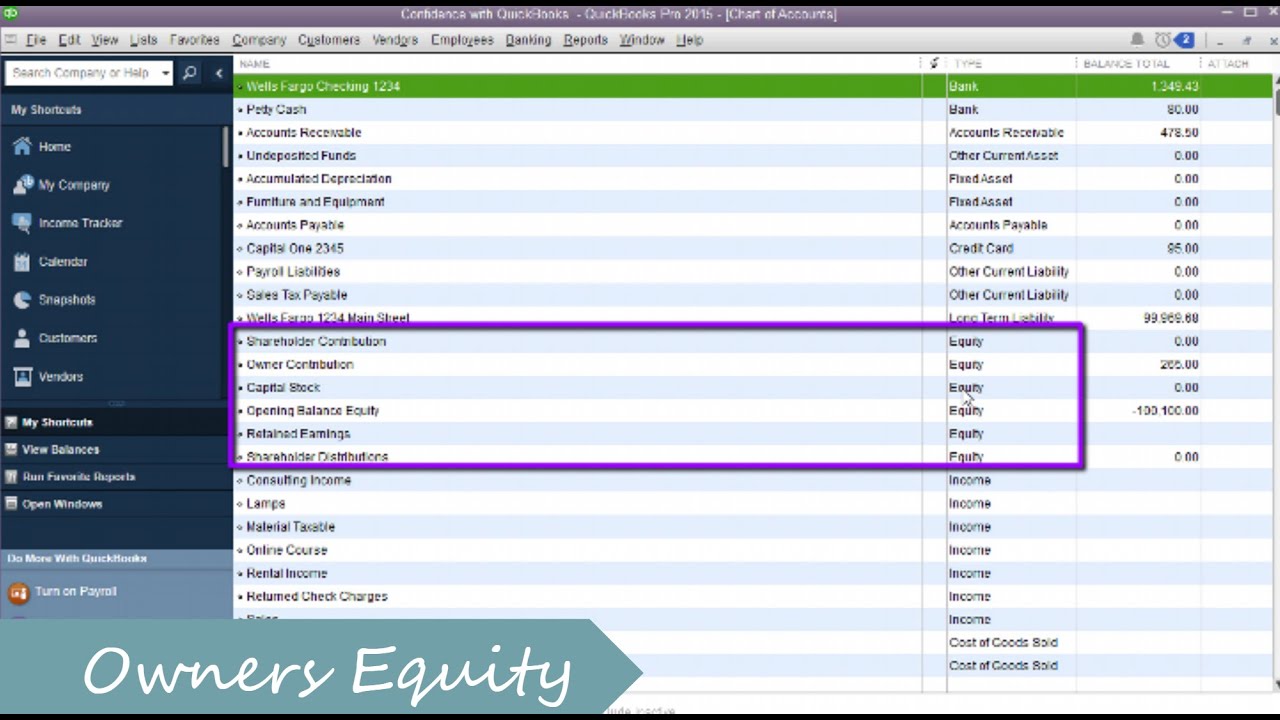

How To Set Up A Chart Of Accounts In Quickbooks Qbalance Com

How To Setup And Use Owners Equity In Quickbooks Pro Youtube

How To Structure The Equity Section Of Your Balance Sheet In Quickbooks Online Youtube